ACADEMICS

CURRICULUM

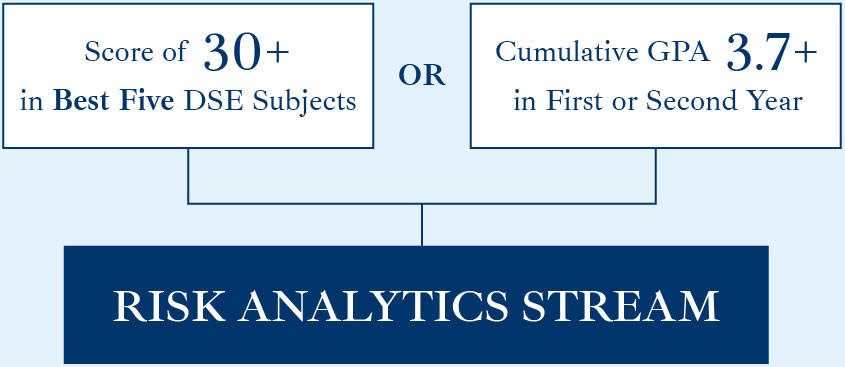

We offer state-of-the-art courses on quantitative risk management…

(Note: VEE Mathematical Statistics of SOA can be exempted by taking STAT 4003.)

*RMSC4005 and RMSC4006 will be offered in alternate years.